Results for March and the 1st quarter of 2024 outpace last year's MLS® sales, average prices and dollar volume

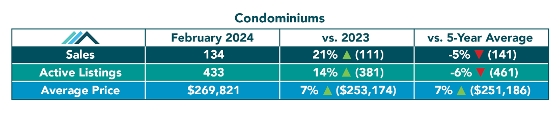

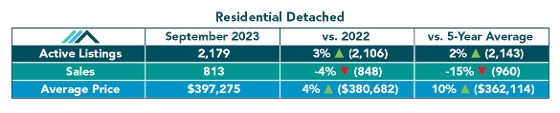

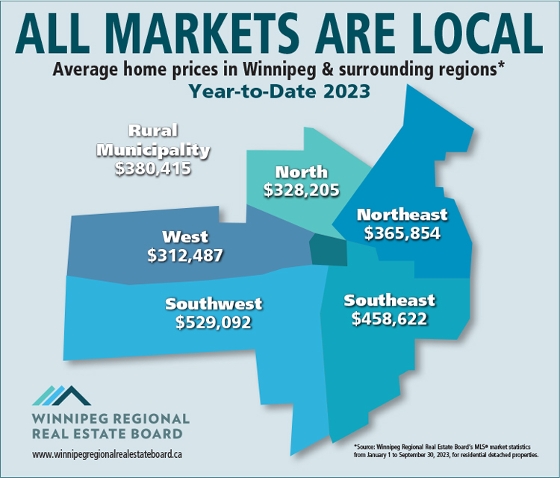

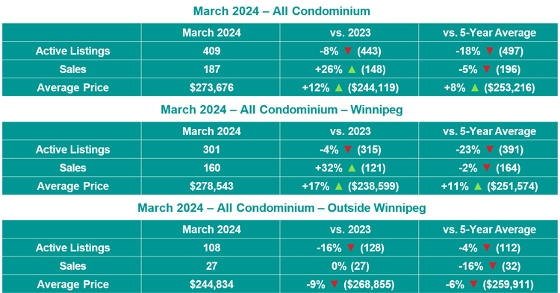

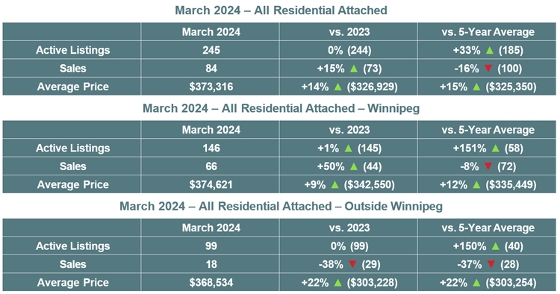

Winnipeg, April 9, 2024 – For March, the Winnipeg Regional Real Estate Board reported All MLS® sales of 1,120, an increase of 11% from last year. When compared to March of 2023, All MLS® active listings of 3,385 were up 1%, and total MLS® dollar volume of $420 million was up 21%. Residential detached MLS® sales of 745 were up 7% while the average residential detached MLS® price of $418,478 was up 8% when compared to March 2023.

“The end of March marked the end of the first quarter of 2024 and there were positive real estate market trends seen with MLS® sales, average prices and dollar volume," said Daphne Shepherd, 2024-2025 President of the Winnipeg Regional Real Estate Board. “The real estate market performance saw increases to MLS® sales and dollar volume each month from January to March with March and the 1st quarter totals also up when compared to the same periods last year. When looking at average prices for residential detached, condominium and residential attached homes in March and in the 1st quarter of 2024, all were up over last year. "

First quarter, year-to-date residential detached MLS® sales were up 11% to 1,682 when compared to the 1,517 seen through March 2023. Year-to-date residential detached MLS® average prices were up 8% to $407,524 from the $378,877 seen last year. Year-to-date residential detached sales dollar volume was up 19% to $685 million compared to the $575 million seen through March of 2023.

“As the weather begins to warm, the spring market season is around the corner and many in our market region will be looking to enter the real estate market," said Marina R. James, CEO of the Winnipeg Regional Real Estate Board. “Whether you're curious about real estate market trends, pricing, home renovations, or popular neighbourhoods, a REALTOR® will have expert advice to share along with a network of professionals who can help.

Results for March and the 1st quarter of 2024 outpace last year's MLS® sales, average prices and dollar volume

WINNIPEG, April 9, 2023 – March and the first quarter totals saw increases to MLS® sales and dollar volume when compared to the same periods last year. Average prices for residential detached, condominium and residential attached homes saw a similar real estate market performance with increases over last year for March and through the 1st quarter.

- Waverley West was the neighbourhood in Winnipeg which saw the most residential detached homes sold in March followed by Island Lakes/Royalwood.

- The Steinbach area saw the most residential detached homes sold outside Winnipeg in March followed by the Morden/Winkler area.

- The most active residential detached price range was the $550,000-$599,999 range with 64 MLS® sales in March representing 9% of all residential detached MLS® sales.

- There were four residential detached homes sold for over $1 million in March, with the highest priced at $1.25 million.

- Osborne Village was with neighbourhood in Winnipeg which saw the most MLS® condominium sales in March followed by Waverley West and St. Vital.

- The most active price range for condominiums was the $150,000-$174,999 range with 28 sales in March which represents 15% of all MLS® condominium sales.

- A condominium in St. Charles was the first in 2024 which sold for over $1 million.

Source: Winnipeg Regional Real Estate Board.

Subscribe with RSS Reader

Subscribe with RSS Reader